Primary contents from here.

Net-Zero GHG Emissions Statement

The Okasan Securities Group has established and released its "Net-Zero GHG Emissions Statement" in January 2024.

Net-Zero GHG Emissions Statement

Based on the recognition that climate change is both a pressing global issue and important social issue, the Okasan Securities Group treats it as a key management issue (materiality), and is addressing it through its business activities. The Group supports both the Paris Agreement and the Japanese government's 2050 Carbon Neutral Declaration and has declared the following goals to help the transition to and realization of a decarbonized society:

- Achieve the net-zero target for its GHG emissions (Scopes 1 and 2) by 2030.

- Support the transition to a decarbonized society through its business activities.

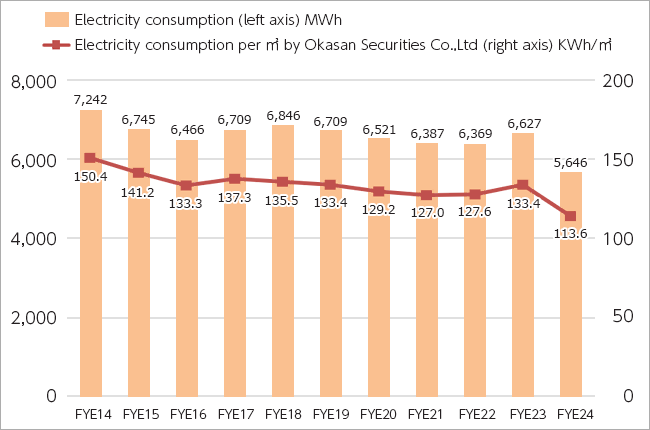

Reducing Energy Consumption

The Okasan Securities Group aims to reduce energy consumption through mindful actions towards the environment.

The core subsidiary, Okasan Securities Co., Ltd., has reduced its standby power consumption by installing LED lights, revamping AC systems and office equipment to eco-friendly models at each of its branch offices, or through office relocations and renovations. As a result, Electricity consumption throughout the company decreased by 21.0%, and Electricity consumption per m² by Okasan Securities Co., Ltd. decreased by 21.9% compared to that of FYE2014.

Response to the TCFD

The Okasan Securities Group considers efforts to realize a sustainable society, including efforts to respond to climate change, as one of its key management issues. It has expressed support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) and carries out information disclosure pursuant to these recommendations. The Group is also a member of the TCFD Consortium.

1. Governance

The Sustainability Committee, chaired by the Group CEO, primarily oversees the Company's response to sustainability issues, including climate change.

The Committee deliberates on matters such as the direction of sustainability initiatives, specific activities and efforts, and the identification and evaluation of risks and opportunities.

The Committee is administered by the Sustainability Department and is, in principle,convened at least once a year.

The reviewed subjects will later be reported and discussed by the Board of Directors and the Management Conference , while the Board of Directors oversees the process.

2. Strategies

- Connections to materialities

In October 2021, the Okasan Securities Group identified and announced materialities (key issues). The Group considers "creation of society" (realization of a sustainable society, including efforts to respond to climate change) as one of the issues it needs to work on through its business activities. The Group promotes efforts to find solutions to social issues and promotes contribution to local communities by offering sustainable finance and ESG funds and by providing information on sustainable investment. -

Scenario Analysis

With these issues in mind, the Group undertook a scenario analysis to identify risks and opportunities related to climate change. To prepare for a wide range of potential outcomes caused by climate change, the Group assumed two scenarios: the 1.5/2℃ scenario (adequate implementation of decarbonization efforts) and the 4℃ scenario (inadequate implementation of climate action). It has set forth the risks and opportunities to consider in each scenario and calculated the business impact.

- 1.5/2℃ scenario: Relatively significant impact of transition risks from market shifts and tightened regulations intended to curb climate change

- 4℃ scenario: Relatively significant impact of physical risks from flooding and other natural disasters

In its scenario analysis, the Group used scenarios adopted by the International Energy Agency (IEA) and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS).

① Qualitative analysis of risks and opportunities

For qualitative analyses based on these two scenarios, the Group set transition and physical risks expected to occur due to climate change in each scenario; identified those likely to be relatively significant for Group strategies and businesses; and analyzed their anticipated impact (including commercial impact on the Group) and time of occurrence.Table 1. Anticipated impact on the Okasan Securities Group

Risks Anticipated impact Expected window* Impact 1.5℃

/2℃4℃ Transition risks Policies and legal regulations Increasing cost due to a contraction of existing businesses or rising capital burdens due to regulatory and legislative change Medium- to long-term Moderate Moderate Market Obsolescence of existing funds and other products due to changing customer needs prompted by climate change and a decline in competitive advantages in new product development Medium- to long-term Moderate Moderate Market Declining businesses with enterprises significantly affected by changing industrial structures over the course of the transition to a low-carbon society Medium- to long-term Large Moderate Market Declining value of assets on hand and shrinking opportunities to sell them off Medium- to long-term Moderate Moderate Reputation Risk of reputational damage due to investments in businesses associated with high environmental impact; deterioration of the brand image of enterprises and products that disregard climate change risks Short- to long-term Large Moderate Physical risks Acute Shutdowns of company facilities and business infrastructures after typhoons, tsunami, flooding, and other natural disasters; increase in cost, such as recovery and operating costs; and emergence of employee support costs, etc. Short- to long-term Moderate Large Acute Declining wholesale business due to growing operating costs triggered by customer shutdowns caused by typhoons, tsunami, flooding, and other natural disasters Short- to long-term Moderate Large Acute Slowing retail business due to declining personal assets, with increasingly severe extreme weather events and disasters proving catastrophic due to climate change, and economic conditions becoming dire. Short- to long-term Moderate Large * Expected windows include the short term (within three years from now), the medium term (three to 10 years), and the long term (10 to 30 years).

Events expected to have a significant impact on the Group are assumed to be as follows:

With regard to transition risks, declining business opportunities with customers significantly affected by the transition to a low-carbon society, and rising procurement costs and declining business opportunities associated with reputational damage that will occur if Group measures to address climate change risks are perceived to be inadequate. With regard to the physical risks, incurrence of costs due to the destruction of group facilities and business infrastructures in the event of natural disasters and declining Group business due to the significant impact of natural disasters on customers.The Group anticipates various business opportunities, as set forth in Table 2.

Table 2. Business opportunities for the Group

Opportunities Expanding business opportunities related to adaptation, including green finance, transition finance, and solutions businesses Expanding markets due to rising confidence in ESG-related products and growing awareness among individual investors Expanding opportunities to handle sustainable bonds, green bonds, and other products focused on sustainability and the environment The Group will seize these opportunities by strengthening its capacity to offer diverse financial services.

② Quantitative analysis of the risks and opportunities

In addition to qualitative analysis, the Group has performed a quantitative analysis based on the above-mentioned scenarios as preliminary calculations of the financial impact in 2030.With regard to transition risks, the Group analyzed the impact of cost increases prompted by the introduction of carbon taxes and the impact of reputational damage on procurement costs, and the knock-on effects on commissions earned from Group securities business. With regard to physical risks, the Group analyzed the impact of various acute risks, including business shutdowns, damage to company facilities, and major market fluctuations due to flooding at operational sites. The flood damage is assumed to occur at major Group sites, which are located in Japan.

With regard to the transition risks, the analysis indicates the importance of expanding relevant businesses and maintaining the Group's reputation for climate action, by continuing to pursue Group initiatives related to decarbonization and sustainable finance. With regard to physical risks, the analysis points to the need for risk management capable of handling the market impact that may be triggered by climate disasters, as there will be indirect impact imposed via the market in addition to the direct impact of flooding and other extreme weather events.

In either scenario, the preliminary calculations made it clear that the Group's earnings will be reduced should it fail to take appropriate action in response to the risks and opportunities presented by climate change. In contrast, if the Group can take appropriate action and seize the opportunities that emerge, the financial impact will be significantly more limited.

-

Roadmap to a decarbonized society

Based on the recognition that climate change is both a pressing global and an important social issue, the Group treats it as a key management issue (materiality) as stated in (a) Connections to materialities, and is addressing it through its business activities. The Group supports both the Paris Agreement and the Japanese government's 2050 Carbon Neutral Declaration. To support the transition to and the realization of a decarbonized society, the Group announced its Net-Zero GHG Emissions Statement, which encompasses the goals of achieving the net-zero target for its GHG emissions (Scopes 1 and 2) by 2030 and supporting the transition to a decarbonized society through its business activities, and has been assiduously working on related activities. The future specific plans are as follows:(i) Achieving the net-zero target for its GHG emissions (Scopes 1 and 2) by 2030

To reduce its GHG emissions (Scopes 1 and 2), the Group will continue its energy-saving activities while expanding the use of renewable energy.

The former will include enhancing the efficiency of energy use at each facility;

The latter will include introducing EVs and electric motorcycles, as well as promoting the shift to renewable energy for electricity consumption.(ii) Supporting the transition to a decarbonized society through its business activities

The Group has launched various initiatives to help resolve social issues, including climate change. These include underwriting and offering green bonds and other SDGs bonds and providing information via seminars and reports for investors and issuers. The Group remains committed to promoting and expanding the availability of sustainable finance.

3. Risk Management

The Okasan Securities Group believes that climate change risks (including transition risks and physical risks) affect the occurrence of natural disasters and environmental issues, the economic environment, and also the management environment including finances.

Risks related to sustainability, including climate change, are identified and assessed by the Sustainability Committee.

These risks are managed as an independent risk category, "ESG-related Risks," within a group-wide approach.

4. Indicators and targets

(a) GHG emissions

The Okasan Securities Group is striving to achieve the net-zero target for its GHG emissions (Scopes 1 and 2) by 2030 and has promoted various initiatives to identify and reduce emissions in accordance with the basic guidelines of the Ministry of the Environment and the Ministry of Economy, Trade and Industry, which are consistent with the GHG Protocol. The Group will continue to take measures to reduce the energy consumed and GHG emitted during its business activities.

GHG emissions (unit: t-CO2)

| Results | Targets | ||||

|---|---|---|---|---|---|

| FYE2022 | FYE2023 | FYE2024 | FYE2025 | FYE2031 | |

| Scope1 | 993 | 984 | 689 | 759 | Net zero |

| Scope2 | 2,952 | 2,827 | 2,058 | 1,912 | Net zero |

(b) Underwriting of SDGs bonds

Okasan Securities Co., Ltd., a core company of the Group, was registered in 2020 on the Green Bond Issuance Promotion Platform. It has been working to help counter climate change and other social issues by underwriting and offering green bonds and other SDGs bonds.

Underwriting of SDGs bonds

| FYE2022 | FYE2023 | FYE2024 | FYE2025 | |

|---|---|---|---|---|

| Amount underwritten (in billions of yen) | 16.20 | 32.10 | 45.83 | 78.64 |

| Number underwritten | 12 | 19 | 34 | 42 |

Based on the recognition that the risks and opportunities related to climate change are one of the important management issues, the Group will continue to promote its information disclosure in accordance with the TCFD recommendations and continue to make efforts to decarbonize its operations and help achieve a sustainable society.

Participation in JCI (Japan Climate Initiative)

Since July 2024, the Okasan Securities Group has participated in JCI (Japan Climate Initiative). JCI is a network of Japanese companies, municipalities, and civil society organizations that are making serious efforts towards climate action. The organizations are committed to strengthening communication and exchange of strategies towards the realization of a decarbonized society. Members of the JCI participate at the forefront to help transition the world towards a decarbonized society.

Industry Engagement

Okasan Securities Co., Ltd., the core subsidiary of the Okasan Securities Group, is a member of the Japan Securities Dealers Association (JSDA). The JSDA is an Authorized Financial Instruments Firms Association, which contributes to the protection of investors by ensuring fair and smooth trading in securities or other transactions by Association Members and promote the sound development of the Japanese financial instruments business.

The JSDA has set a numerical goal on decarbonization, "striving for a reduction of over 51% on CO2 emissions by FYE2031, compared to that of FYE2014: measured by Electricity consumption per m² of all operators of Association Members." The Group supports this goal as it aligns with its own "Net-Zero GHG Emissions Statement."

The Group also supports and responds accordingly to Japanese laws, regulations, and policies that encompass topics surrounding climate change and reducing energy consumption. These include the "Act on Promotion of Global Warming Countermeasures" and the "Act on Rationalization of Energy Use and Shift to Non-fossil Energy."

Environmental Conservation and Biodiversity

Incorporating Eco-Friendly Products

The Okasan Securities Group and its subsidiaries use recycled paper, FSC-certified paper, and soy-based ink to improve environmental sustainability. These are used for the Group's integrated report (available in Japanese), as well as a portion of pamphlets and newsletters.

Okasan Securities Co., Ltd. has switched from using plastic file folders to paper alternatives and has introduced limestone-based LIMEX file folders.

Registration as a "Wood Utilization Declaration" Business

At the Okasan Securities Ise Branch, we believe that to realize the multifaceted functions of forests and to achieve the sustainable and sound development of the forestry industry, it is crucial to increase the use of locally sourced timber and to establish a green cycle of "planting → nurturing → harvesting → replanting."

To promote this green cycle, it is necessary to collaborate with various entities, including businesses, to expand the utilization of forest resources.

In support of this principle ,we registered as a "Wood Utilization Declaration" business in Mie Prefecture in June 2025.

Participation in the Eyecity Eco Project (Collection of Empty Contact Lens Cases)

As part of a recycling and donation initiative involving employee participation, we have been participating in the " Eyecity Eco Project," which promotes the collection of empty disposable contact lens cases led by HOYA Corporation since August 2021.

We have set up collection boxes at over 50 locations nationwide and, from October 2021 to March 2025, we have collected a total of 120 kg (with 35 kg collected in FYE 2025) across the entire group.

Through the donation of these empty contact lens cases, we have been contributing to "environmental conservation through the recycling of empty cases," "support for the independence and employment of people with disabilities," and "donations to the Japan Eye Bank Association (public interest incorporated foundation)."

Other Eco-Friendly Activities

| Conserving Energy: |

|

|---|---|

| Going Paperless: |

|